Escape Your Credit With Our Repair Solutions

Remove your credit issues and maximize your credit score in as little as 45 days

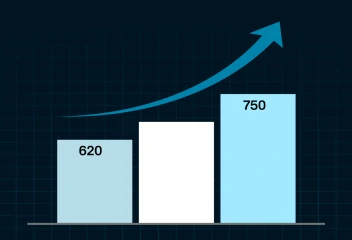

80% Success Rate

Client Results

4,853

31.9 Million

97.5% Success Rate

3,887

How Many Negative Credit Items Do You Have?

Item Removal Package

01

- Removal from all 3 credit bureaus

- Credit optimization

- Pay for delete

- Lawsuit filing*

Item Removal Package

02

- Removal from all 3 credit bureaus

- Credit optimization

- Pay for delete

- Lawsuit filing*

Item Removal Package

03

- Removal from all 3 credit bureaus

- Credit optimization

- Pay for delete

- Lawsuit filing*

Item Removal Package

04

- Removal from all 3 credit bureaus

- Credit optimization

- Pay for delete

- Lawsuit filing*

Is your credit score holding you back?

We understand that life can throw some brutal punches. Whether it’s overdue bills, maxed-out credit cards, or a history of missed payments, we believe in confronting your credit problems head-on with ruthless efficiency.

How is We Credit Repair different from the rest?

- Attorney lawsuit filing*

- Regulatory Complaints filed

- Customized Credit Repair Plan

- Results in as little as 45 Days

- Zero Fees due if no results

Our Service Includes

Brutal Credit Analysis

Uncover the harsh realities of your credit situation with our no-holds-barred credit analysis.

Aggressive Debt Disputes

Take a stand against unfair creditors and erroneous negative items with our aggressive debt dispute services.

Strategic Default Guidance

Sometimes, defaulting on your debts can be a strategic move toward financial liberation.

Debt Settlement Tactics

Escape the suffocating grip of unmanageable debt with our aggressive debt settlement tactics.

Credit Scorched-Earth Strategy

In some cases, the only way to move forward is to burn the bridges behind you. Our scorched-earth strategy…

Fallout Management

After the dust settles, it’s time to rebuild. Our fallout management and recovery services will guide…

Hi I’m Alex Slat

Meet Alex Slat, the visionary force behind [Company Name]’s groundbreaking Negative Credit Repair Solutions. With a passion for empowering individuals to take control of their financial destinies, Alex brings a unique blend of expertise, innovation, and tenacity to the world of credit repair.

Driven by a deep-seated belief that traditional approaches to credit repair often fall short, Alex embarked on a mission to revolutionize the industry. Drawing from years of experience in finance and a keen understanding of consumer rights, Alex developed a bold and unconventional approach to tackling bad credit head-on.

CEO and Credit Advocate

Alex Slat

What Clients are Saying?

Adam Smith

I cannot express enough how grateful I am for the incredible support I received from Mortgage Mastery. Their team went above and beyond to help me repair my credit and secure a mortgage. They were thorough, professional, and truly cared about my success. Thanks to their expertise, I am now a proud homeowner. Highly recommend!

Jhon Deo

If you're struggling with credit issues and dreaming of owning a home, look no further than Mortgage Mastery. Their personalized approach and in-depth knowledge of credit repair made all the difference for me. They guided me through every step of the process, and I couldn't be happier with the results. Thanks to Mortgage Mastery, I'm now on the path to homeownership!

Maria Mak

I was skeptical about whether I could ever qualify for a mortgage due to my poor credit history. But Mortgage Mastery proved me wrong! Their team worked tirelessly to improve my credit score and educate me on better financial practices. Thanks to their dedication and expertise, I am now a proud homeowner. I can't thank them enough for changing my life!

Jackma Kalin

Mortgage Mastery exceeded all my expectations. From the initial consultation to the final result, their professionalism and commitment were evident. They helped me navigate the complexities of credit repair with ease, and thanks to their guidance, I was able to secure a mortgage sooner than I ever thought possible.

Frequently Asked Questions

The timeline for mortgage credit repair can vary depending on individual circumstances such as the complexity of credit issues and the responsiveness of creditors and credit bureaus. Typically, significant improvements can be seen within a few months, but it may take up to a year or longer to achieve optimal results.

While improving your credit score is a crucial step in qualifying for a mortgage, it’s not the only factor lenders consider. Other factors such as income, employment history, debt-to-income ratio, and down payment amount also play a significant role in the mortgage approval process. However, repairing your credit can greatly increase your chances of securing a mortgage with favorable terms.

While it’s possible to attempt credit repair on your own, working with a professional mortgage credit repair service can provide several advantages. Experienced professionals have in-depth knowledge of the credit system and can navigate it more effectively. They can also provide personalized guidance and strategies tailored to your specific credit situation, potentially accelerating the process and maximizing results.

Disputing inaccuracies or errors on your credit report is a legal right under the Fair Credit Reporting Act (FCRA) and should not negatively impact your credit score. However, the removal of legitimate negative items, such as late payments or collections, can potentially result in a temporary decrease in your credit score before seeing improvement.

Disputing inaccuracies or errors on your credit report is a legal right under the Fair Credit Reporting Act (FCRA) and should not negatively impact your credit score. However, the removal of legitimate negative items, such as late payments or collections, can potentially result in a temporary decrease in your credit score before seeing improvement.

Fix Your Credit to Get Approved for Loans

Credit Repair for Mortgages

Uncover the harsh realities of your credit situation with our no-holds-barred credit analysis.

Credit Repair for Business Loans

Take a stand against unfair creditors and erroneous negative items with our aggressive debt dispute services.

Credit Repair for Auto Finance

Sometimes, defaulting on your debts can be a strategic move toward financial liberation.

Any Questions?

Our team of credit repair experts are just a click or call away. Find credit repair near me or call us: